Tooling + Injection Molding for OEMs — DFM-First Quotes in 24 Hours

Topworks Plastic Mold is a China injection molding manufacturer specializing in custom tooling and plastic part production for OEM manufacturers. We support procurement and engineering teams with stable, scalable mass production — not just a low tooling price. Submit your CAD files and requirements to receive a quote-ready cost range with written assumptions, including cavity count, cycle time, scrap rate, steel selection, and project scope.

What we manufacture

Focused on OEM programs that need repeatable mass production

Topworks supports prototype tooling to production across three categories. If your part has undercuts, tight CTQs, or cosmetic zones, we treat those as first-class requirements during DFM.

Automotive parts

Functional components with CTQ control, stable cycle time planning, and disciplined change management.

Electronics enclosures

Cosmetic zones + assembly fit aligned early to reduce sink/flow marks, warpage, and flash risk.

Appliance parts

Stable output for structural and cosmetic parts, with optional labeling/packaging aligned to spec.

Capabilities snapshot

Tooling + production built for stability

DFM-first

Draft, parting line, gating, ejection, cooling concept aligned before steel cutting.

Undercuts

Slides/lifters/side actions designed for maintenance and repeatable demolding.

Runner systems

Cold runner or hot runner — chosen based on resin, volume, and waste control.

Materials

PP/ABS/PC/PA/POM + filled resins (wear considerations included in scope).

CTQ control

CTQ dimensions confirmed early; measurement approach aligned to avoid disputes.

Quote clarity

We write assumptions (CT, scrap, scope) so procurement can compare suppliers fairly.

Comparable quote

We state assumptions in writing to prevent surprises

Many “cheap” molds produce expensive parts for years. We make quotes comparable by documenting what’s assumed and what’s included.

| Quote assumption | What we define | Why it matters |

|---|---|---|

| Cycle time (CT) | Target CT + how it will be validated during trials | CT drives unit cost and capacity |

| Scrap rate | Expected scrap + key controls | Scrap changes true part cost |

| Tooling scope | Steel, cavities, mechanisms, runner, finish, included trials | Avoids scope gaps and add-ons |

| Quality scope | CTQ measurement method, inspection level, reporting | Prevents acceptance disputes |

| Change management | Revision control + approvals | Stops uncontrolled rework |

| Packaging / shipping | Label/pack spec + incoterms | Avoids logistics surprises |

Process

DFM → Tool design → Trials → Ramp-up

A simple process with clear deliverables protects cost, quality, and timeline.

Case studies

Measurable improvements, not generic claims

Automotive part — warpage reduced

Measured deformation, modified slide/core geometry, refined parameter window to stabilize output.

Electronics enclosure — appearance zones aligned

Aligned cosmetic zones early, clarified CTQs & measurement method, reduced late rework risk.

Appliance part — predictable unit cost at volume

Documented CT/scrap/scope to keep quotes comparable and avoid production cost surprises.

Quality deliverables

ISO system + practical documentation

ISO certification matters — but procurement needs deliverables. Depending on requirements, Topworks supports:

FAQ

Questions procurement teams ask before approving a supplier

What do you need for an accurate injection molding quote?

Are you an ISO-certified injection molding company in China?

How do you make supplier quotes comparable?

Can you support automotive parts, electronics enclosures, and appliance parts?

What affects unit cost the most in mass production?

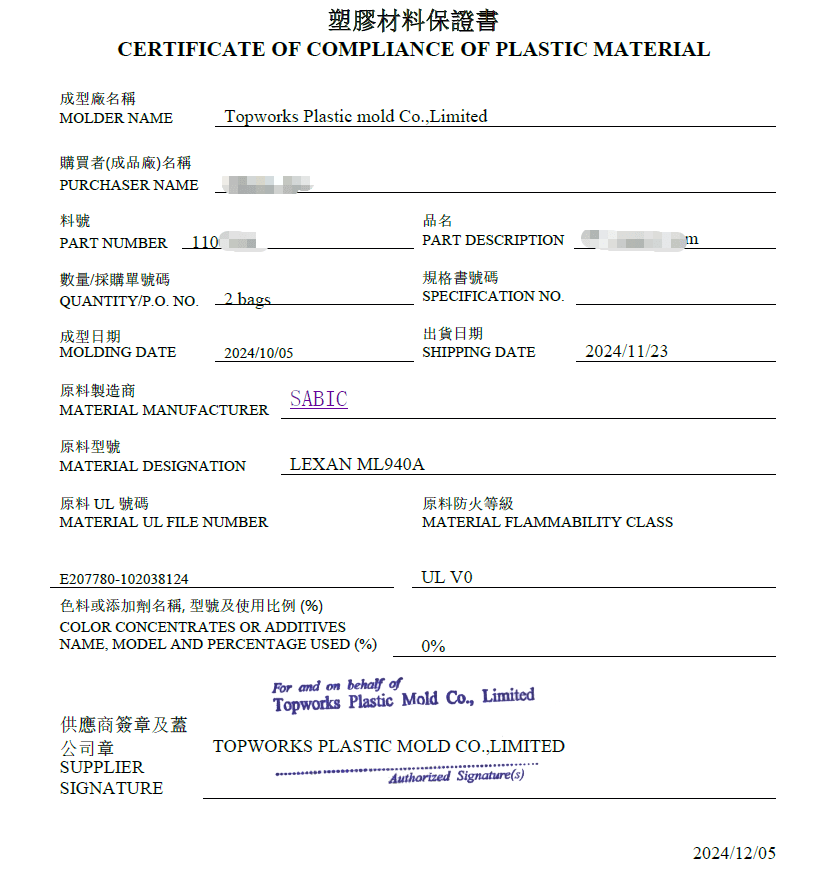

Factory proof

Material, Hardness, CTQ & Compliance Verification

Real factory evidence used in injection mold tooling and mass production programs. This section is designed to help procurement teams verify that Topworks operates as a manufacturer (not a trading intermediary).

Topworks injection molding capacity:15 injection molding machines with 160–800T clamping force, plus 4 electric drying ovens and 8 mold temperature controllers (80–150°C). This setup supports stable molding conditions, better dimensional consistency, and repeatable quality for both engineering plastics and general-purpose resins.

Quick capability facts

- Injection machines: 15

- Clamp tonnage: 160–800T

- Drying ovens: 4 (electric)

- Mold temp controllers: 8

- Temp range: 80–150°C

Topworks injection molding capacity:15 injection molding machines with 160–800T clamping force, plus 4 electric drying ovens and 8 mold temperature controllers (80–150°C). This setup supports stable molding conditions, better dimensional consistency, and repeatable quality for both engineering plastics and general-purpose resins.

Quick capability facts

- Injection machines: 15

- Clamp tonnage: 160–800T

- Drying ovens: 4 (electric)

- Mold temp controllers: 8

- Temp range: 80–150°C